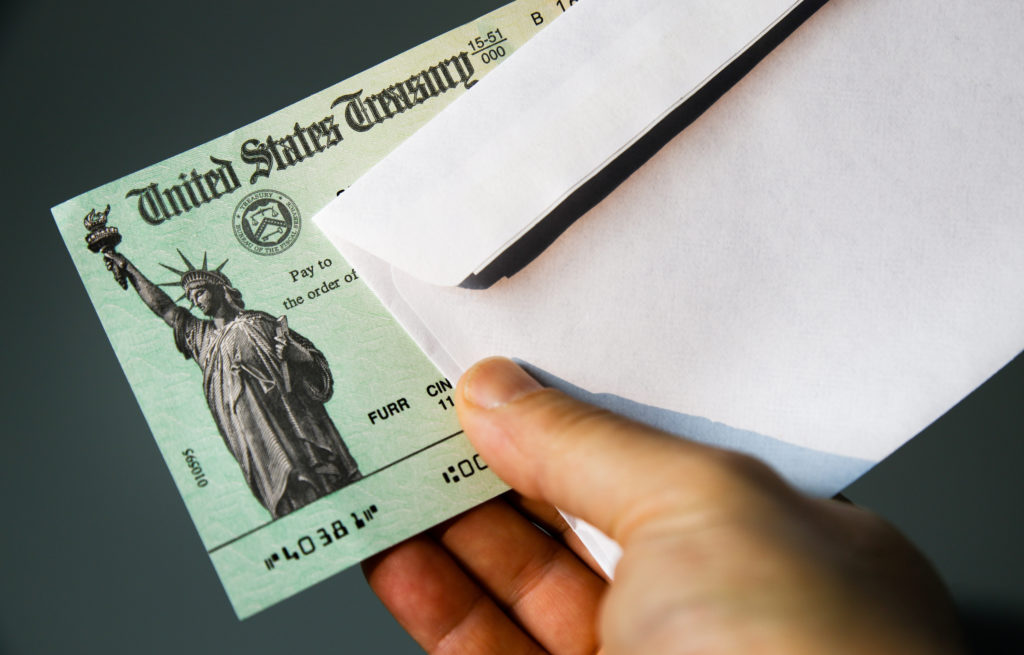

While we all navigate the COVID-19 pandemic, the federal government is in the process of issuing economic impact payments, being referred to by many as federal stimulus checks, to all eligible citizens and U.S. residents. It is important to understand the purpose of the stimulus payments, who is eligible, and how much you may receive. There is also the issue of the division of the stimulus check. How should the check be divided between a couple? Child support and the federal stimulus check is a complicated discussion.

Here are the federal stimulus check facts:

1. Single and married filing separate taxpayers earning less than $75,000 in adjusted gross income will receive $1,200. Such taxpayers earning between $75,000 and $99,000 will receive a reduced amount, and those earning over $99,000 are not eligible.

2. Head of household filers will also receive $1,200 if they earn less than $112,500. Such taxpayers earning between $112,5000 and $136,500 will receive a reduced amount, and those earning over $136,500 are not eligible.

3. Married filing joint filers earning less than $150,000 in adjusted gross income will receive $2,400. Such taxpayers earning up to $198,000 will receive a reduced amount, and those earning over $198,000 are not eligible.

4. All eligible taxpayers will also receive an additional $500 per qualifying child (under 17 and those meeting the requirements to qualify for the Child Tax Credit), with this amount also phasing-out for higher income earners.

Please see https://www.irs.gov/coronavirus/economic-impact-payment-information-center for more information.

The IRS is basing each taxpayer’s eligibility on his or her 2019 tax return if filed, or his or her 2018 return if 2019 is not yet filed.

Taxpayers do not need to do anything to receive their economic stimulus payment unless they were not required to file a tax return in 2018 and 2019, in which case they may need to complete a form with the IRS.

The payments will be directly deposited to the bank account previously designated on the taxpayer’s tax return or a check will be mailed.

Please see https://www.irs.gov/coronavirus/economic-impact-payment-information-center for more information.

It is also important to know that taxpayers owing child support arrearages through state enforcement agencies may not receive their economic impact payments, which may be intercepted by the Treasury.[1]

Child Support and the federal stimulus check

Many divorced parents with children under 17 are wondering how the qualifying child credit portion of the economic impact payment will work for them. The qualifying child credit of the economic stimulus payment should automatically be issued to the taxpayer who claimed the child as a dependent qualifying for the Child Tax Credit on his or her tax return since the IRS is basing the payments on previously filed tax returns and the tax filing system.

Who gets to claim the child is typically set forth in the parties’ Marital Settlement Agreement or Judgment of Dissolution of Marriage, subject to tax rules and regulations as to the child’s eligibility. This makes matters more complicated as the exemption may be alternated between parties, and the credit is being received in 2020 but based on prior years tax returns in 2019 or 2018. This may not be an issue if both parents claim different children in a multi-child family, resulting in a division of the qualifying child credits.

But what should you do if your ex-spouse received the qualifying child credit or you received it and your ex-spouse is asking you to split it?

First, try to have a conversation with your ex-spouse to discuss what you believe is fair in dividing the stimulus check, taking into consideration who is currently caring for the child, your respective employment circumstances, your respective incomes, and other factors.

Keep in mind that the purpose of the economic stimulus check is to help with paying essential living expenses. Discuss who needs this money more for essential spending. If one party earns more than the cutoffs to be eligible or is subject to a reduced credit due to the income phase out, that person arguably should not receive any of the credit.

If both parties are eligible and if you cannot reach an agreement to divide the stimulus check, you can attempt to file a motion with the court requesting the court to order the equitable division of the credit (equitable meaning fairly, not necessarily equally).

You can also seek to resolve this issue in mediation prior to seeking court involvement. Given that this situation and credit is unprecedented, different judges may have different opinions on whether they have the authority and jurisdiction to divide the credit since the parties are already divorced and property has already been divided between the parties. Therefore, the outcome may vary from case to case and judge to judge.

You should also consider the time and cost associated with seeking court intervention on this narrow issue during this time. In other words, the cost of litigation may end up slicing into the stimulus check or even end up being higher.

But, if you are already engaged in litigation with your former spouse, it may make sense to add this issue to the table.

In closing, child support and the federal stimulus check is a complicated discussion, and every situation is unique. If couples can take emotion out of the discussion and be honest and upfront about the needs of their children, the conversation about the stimulus check should go a lot more smoothly. Of course if you are unable to reason with your ex-spouse, or if the two of you cannot come to an agreement, we’re here to help.

[1] https://www.cbsnews.com/news/stimulus-checks-how-much-money-impact/

Kathryn McMahon Vivanco is a divorce attorney and Partner for the law firm of Katz & Stefani. A Fellow of the Collaborative Law Institute of Illinois (“CLII”) and a member of the International Academy of Collaborative Professionals (“IACP”), Kathryn represents clients in family law matters in the collaborative law process, a team based approach to dispute resolution and an alternative to litigation. Kathryn is also a Certified Divorce Mediator. Learn more.

Like this article? Check out, “Five Illinois Divorce Laws to Consider in Your Divorce”