I understand what you are going through.

I went through a divorce several years ago. I had two toddlers, no family in the town where l lived, and barely any online resources. That’s why l created Divorced Girl Smiling: a place you can go to find TRUSTED, VETTED divorce professionals, a podcast, articles, and a community of people going through what you’re going through.

I’m a former Chicago Tribune columnist and TV news reporter, who took my pain and turned it into a company to help YOU. It’s my personal mission to help those facing divorce to feel less isolated and alone, and to help you get through your divorce as smoothly as possible, and with a good outcome, so that you can live a happy, healthy post-divorce life.

I wish you all the best in your divorce journey!

Sincerely,

Founder

Divorced Girl Smiling

Divorce Professionals

With help from the Divorced Girl Smiling advisory board, we choose and vet our Divorced Girl Smiling trusted professionals very carefully.

Click on a Category or Photo to learn more

After

Divorce

Coaches

College Planning

and Preparation

Cryptocurrency Valuation

and Forensics

Dating

Coaches

Diamond and Jewelry

Buyers

Discernment

Counseling

Divorce

Attorneys

Divorce Financial

Preparation

Divorce

Mediators

Divorce Mortgage

Planning

Dog/Pet Custody

and Mediation

Financial Divorce

Coaching

Financial Planning

& Investing

Health and Life

Insurance

Joy Infused

Experiences

Keep Your

Home

Marriage Intensive

Therapy

Mortgage

Lenders

Online Divorce

Courses

Real Estate

Agents

Sensitive

Women

Therapists

Wills and Estate Planning

Attorneys

Alcohol Monitoring

Devices

Co-parenting

programs

Divorce Advocate

Organizations

Divorce

Education

Find the

Money

Home Renovations

to Sell or Stay

Grab a cup of coffee or a glass of wine and join us! You’ll be smiling in no time!

Every episode is hosted by Jackie Pilossoph, along with one of the Divorced Girl Smiling trusted professionals. We cover divorce and dating topics that span from the day you start thinking about divorce, through the entire process to life and love after divorce. Our goal is to arm you with knowledge, inspiration and connections to divorce professionals who can provide you the divorce outcome you want and deserve.

Click here to tune inMost popular episodes

Divorce After 30 Years of Marriage or More

6 Things Every Divorced Woman Should Stop Doing

2 Things That Will Change Your Life: Feeling Worthy and Focusing on Healing

9 Things I Learned During and After My Divorce

4 Words You Should Never Say Again: I Can't Afford It

You can ask AI how to get the best possible divorce outcome – or you could ask me!

Let me provide you with firsthand referrals for divorce attorneys, mediators, divorce coaches, financial advisors, real estate agents, mortgage lenders, therapists, and other divorce professionals-some you might not even realize can help you!

Book your free callNo cost. Always confidential

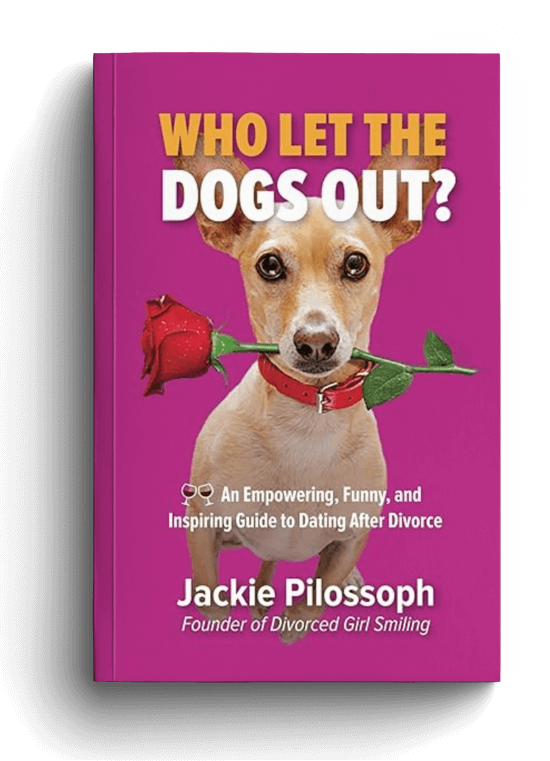

After spending almost 10 years dating after divorce, Jackie Pilossoph, Founder of Divorced Girl Smiling, has stories. Lots of them.

And now, she’s going public with them in her new book,

Who Let the Dogs Out?